Make sure you know all of the fees you might face before opening a checking account. Transaction fees/foreign transaction fees.Be sure to explore what safety features are available with your debit card to keep your hard-earned money safe.ĭepending on where you open a spending account, you may need to pay some fees for your debit card. Although credit and debit cards can be stolen, they come with some key security features to keep your money safe.įor example, Chime is equipped with a variety of great safety features, such as locking and unlocking your card in the app, transaction alerts, and much more. If cash is lost or stolen, it’s usually gone for good. Chime debit cards let you withdraw funds from more than 60,000 fee-free ATMs¹. Just be aware of what ATMs are in your network and what fees might be involved.Ĭredit cards typically charge a cash advance fee of 3-5% of the transaction. This allows you to take out cash, make deposits, and check account details while on the go.

CHIME EMV CARD FREE

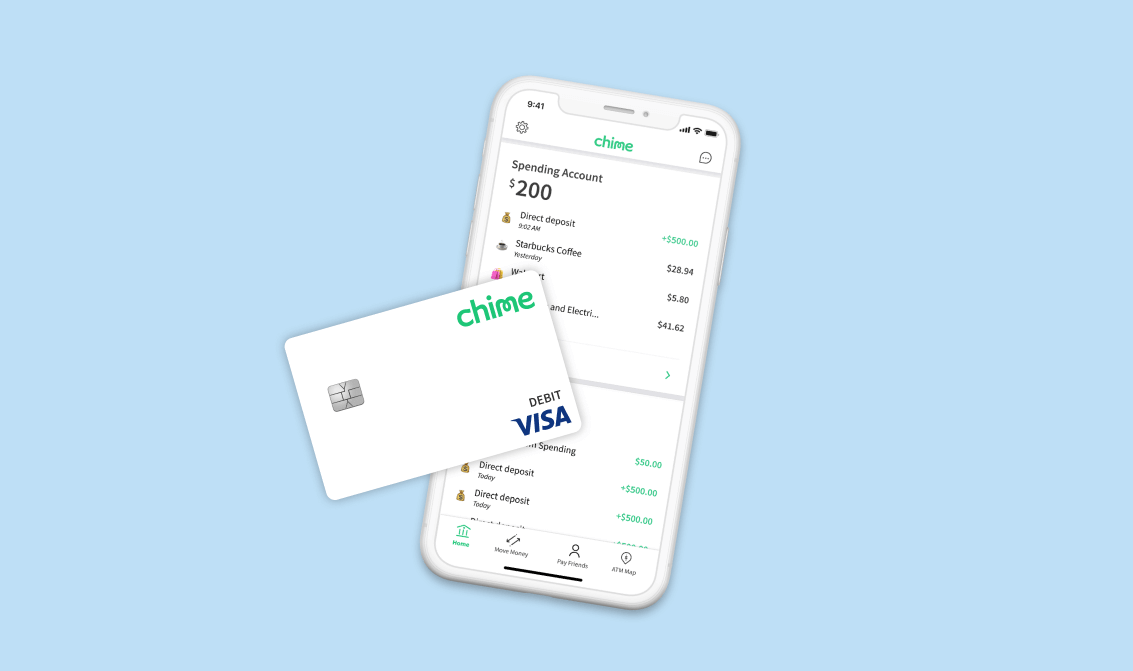

Your debit card provides free or low-cost ATM access. For example, Chime supports the 3 top mobile payment platforms: Apple Pay™, Google Pay™, and Samsung Pay. This depends on what’s supported by your bank, credit union, financial institution, or financial technology company. In some cases, you may be able to use just your phone to make a debit transaction.

CHIME EMV CARD ZIP

When using a debit card online, you will enter your card number, security code, and other details like the card’s expiration date and your zip code, to complete the online transaction. In some cases, you will need to enter a PIN or provide a signature. When using a debit card in person, you will swipe, tap, or insert the card. Once your card’s payment network makes contact with your banking provider, a pre-authorization hold is put on your account to reserve the transaction amount until authorization.ĭebit cards can be used both in person and online. Chime uses Visa®, but other popular options include MasterCard, Discover, and American Express. That communication happens through your card’s payment network. Whether you swipe your card or punch in its numbers online, you’re telling the merchant to deduct the total amount from your checking account. The card is connected to your account, and your spending limit is based on your available funds. But with a debit card, the money comes directly out of your bank account when you use it. Like cash, checks, and credit cards, debit cards let you pay for things.

0 kommentar(er)

0 kommentar(er)